Authors

Clyde T. Stambaugh, Manuel Tipgos, Floyd W. Carpenter, & L. Murphy Smith

Abstract

Accountants, especially internal auditors, external auditors, and forensic accountants, are often called upon to help in efforts to detect and prevent fraud. A variety of methods have been developed to assist in fraud detection and prevention.

This article describes a fraud-detection strategy based on Benford's Law. Benford's Law analysis is a mathematical technique for identifying irregular patterns in data, which might represent red flags that indicate fraudulent activity or material errors.

By using the Benford Analysis Workbook that is described in this paper, internal auditors, external auditors, forensic accountants, and others can readily perform this effective test to help identify possible fraud- or error-infested accounts.

Sample

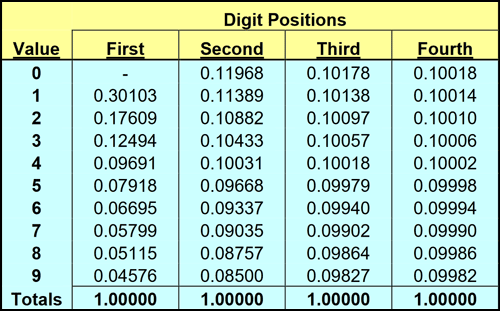

Benford's Law digit probabilities.

Benford's Law postulates that the positional incidence of a specific digit in a large random file of numbers occurs with predictable frequency.

For example, the digit 1 should be in the first position (left-most digit) about 30% of the time, while the digit 9 is expected to be the first digit less than 5% of the time.

Publication

2012, Internal Auditing, May/June, pages 24–29