Authors

Carlos Correia & Tessa Minter

Abstract

Spreadsheet models are pervasive in practice and are increasingly used in the teaching of corporate finance. The use of spreadsheets enables students to obtain the skills required to apply corporate finance theory in the real world.

Yet, there is limited focus in academic courses on the design and layout of financial models to ensure the integrity of spreadsheets, even when the consequences of errors have been shown to be highly significant in practice. Studies have indicated errors in 20% to 80% of operational spreadsheet models and KPMG have reported error rates of over 90%.

The objectives of this paper are to analyse the main risks relating to spreadsheet design, the methods used to minimise quantitative and qualitative modelling errors. These issues are often not addressed in an educational setting.

The consequences of incorrect model design, model structures that increase the potential for errors and a lack of documentation may not be highlighted due to the limited ambit of spreadsheet models in an academic course setting. Yet, non-adherence to the fundamental principles of spreadsheet design can have lasting effects on what students do in the work environment later on.

The paper further analyses how the issues of complexity, interdependencies, model maintenance and "what-if" analysis influence model design. This paper then concludes on how the interrelated issues of model design and layout, avoidance of errors and documentation are crucial in setting up financial models, and how it is necessary to integrate effective spreadsheet design within any corporate finance course.

Sample

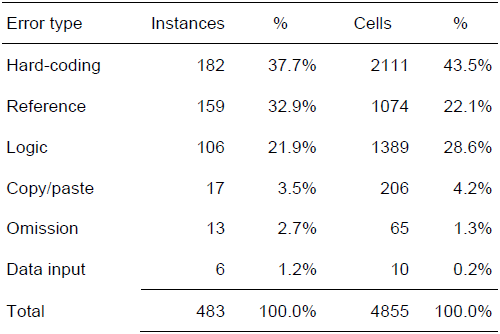

This table shows the instances of error types and the number of cells where each error occurred. Hard-coding is the most common error type.

Publication

2011, 4th International Conference of Education, Research and Innovation, November, 356-365

Full article

The role of spreadsheet model design in corporate finance courses