Authors

Ray Butler

Abstract

Spreadsheet models are commonly used by UK Taxpayers to calculate their liabilities. The risks of error from spreadsheets have been exhaustively documented, and applications in this domain are no less at risk of error than those in any other.

Officers of H. M. Customs and Excise in the United Kingdom have been performing field audits of taxpayers' spreadsheet applications since 1985. Building on the experience gained, H. M. Customs and Excise computer auditors have developed a testing methodology and supporting audit support software for use by generalist tax inspectors.

This paper briefly summarises the audit experience, describes the methodology and outlines the results to date of a campaign of spreadsheet testing started in July of 1999.

Sample

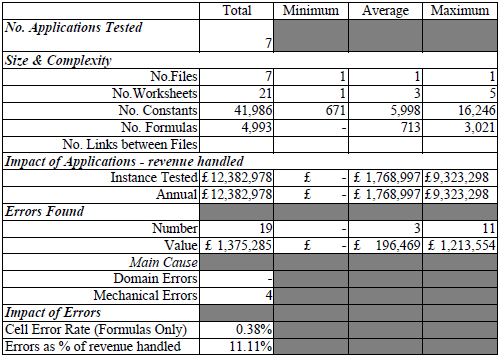

Customs & Excise record the results of spreadsheet testing, to allow monitoring of:

- The use of the audit software and confirm the benefits of its use.

- The number, impact and broad causes of errors (domain or mechanical error).

- The size and complexity of the spreadsheet applications in use for taxation calculations.

The results are summarised in this table.

Publication

2000, 33rd Hawaii International Conference on System Sciences, Volume 7, January