Authors

Franz Hormann

Abstract

Since spreadsheets are tools that not only describe a company's financial history but also tell its future, even tiny errors in one cell can be disastrous. Yet, as CPAs know, spreadsheets usually do contain errors.

While there are ways to ferret out and correct most errors, CPAs should be aware that no foolproof solutions exist. At best, errors can be minimized, so the prudent user should stay alert to the danger and use all the available tools to find them.

Ways to check for and eliminate errors:

- Perform input range checks using the Validation tool.

- Add explanatory comments and names to cells.

- Avoid the option to round off numbers.

- Review all formulas - using the Formulas tool.

- Engage the Auditing toolbar to be able to track the source of errors.

- Examine imported data regularly.

Sample

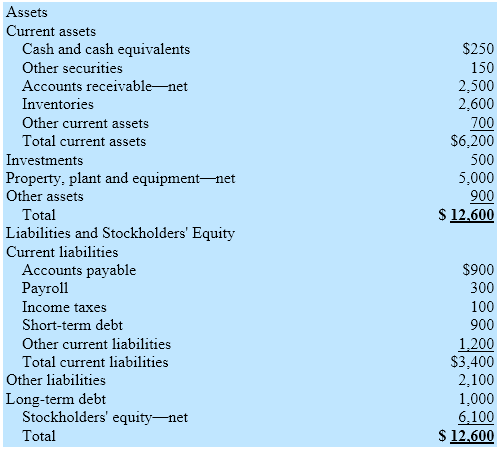

Given a balance sheet, the quick ratio can be calculated two ways:

- Quick ratio = (cash + other securities + receivables) / current liabilities = (250 + 150 + 2,500) / 3,400 = 0.85

- Quick ratio = (balance sheet sum – inventories – other current assets – investments – property, plant and equipment – other assets) / (balance sheet sum – other liabilities – long-term debt – stockholders' equity) = 12,600 – 2,600 – 700 – 500 – 5,000 – 900) / (12,600 – 2,100 – 1,000 – 6,100) = 0.85

This process assures not only the correct calculation of the quick ratio value but also the consistency and completeness of the whole balance sheet.

Publication

1999, Journal of Accountancy, October